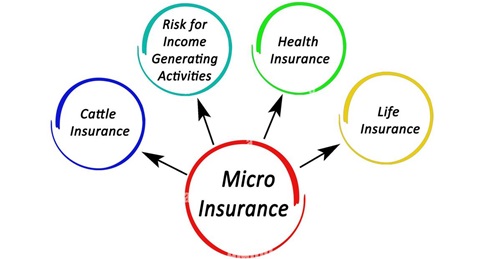

Microinsurance is a crucial way to protect finances for low income people who can’t usually get standard insurance. It is insurance designed to meet the needs of low income people and covers various risks such as health, life and property.

Because this type of insurance is flexible and affordable it can be used by people who need help with their finances. Microinsurance is a big part of attempts to bring more people into the financial system worldwide because it meets the unique needs of neglected areas.

What Is Microinsurance?

Microinsurance is a term for insurance products designed to help low income people and families who can’t usually get standard insurance. These products are designed to meet economically disadvantaged groups’ specific needs and financial situations and protect against various risks including sickness, injury , death , crop failure and natural disasters.

Microinsurance plans differ from regular insurance because they are affordable, have simple terms and have low fees. This means that low income people can get them in rural and urban areas. Its primary goal is to give people and families a safety net that keeps them from going deeper into poverty when bad things happen. This helps neglected communities become more financially stable and resilient.

Why Microinsurance Matters?

Microinsurance is important for many reasons. It first gives low income people a safety net they need access to through standard insurance plans because they can’t afford them. Microinsurance ensures that even the weakest people can get financial safety against risks like illness, crop failure and natural disasters by giving low cost fees and flexible coverage choices.

Microinsurance is vital to ensuring everyone has access to money. It brings underserved groups into official financial systems giving them more economic power and resistance to economic changes. This inclusion not only makes it easier for people to deal with risks but it also helps the economy and society.

Small scale insurance helps reduce poverty by keeping people from falling deeper into it because of unexpected costs. It allows families to bounce back faster from failures and keep making a living breaking poverty loops and encouraging long term growth.

Microinsurance helps people reach bigger goals for society like sustainable development goals. Making communities less vulnerable and more adaptable helps build stronger communities that can handle a range of economic and natural problems.

Challenges And Barriers

Although microinsurance could be helpful it faces several significant problems and obstacles that make it less likely to be widely used by low income people. Cost is still a big problem when it comes to implementing microinsurance. The goal is for low income people to be able to pay the rates but they also need to be high enough to cover claims and management costs. It is always difficult for insurers and authorities to find the right mix between cost and long term viability.

Another problem is that target groups need to learn more about money or be made aware of it. Many people who might be users need to know how insurance works, what benefits it offers or how to file a claim. People who need to learn more about microinsurance are often skeptical or unwilling to invest in it even though it could significantly help them financially.

Rules and regulations can help or hurt microinsurance growth. In some places strict regulations make it difficult for microinsurance companies to run their businesses properly and sustainably. Insurers may also be hesitant to join or grow in microinsurance markets if rules are unclear or vary from one area to another.

Operations problems like getting goods to and from rural or neglected places and providing service are big problems. Infrastructure problems like needing a stable internet connection or banking services can make it harder to gather premiums, issue policies and handle claims. To successfully reach underserved groups insurers must develop new ideas and change how they distribute their products.

Microinsurance is challenging because the risks that low income people face like food failure and health problems change with the seasons and are hard to plan for. It takes a lot of thought and often a specific understanding of local conditions to make goods that adequately cover these risks while still being cheap and long lasting.

Insurers, NGOs and foreign organizations must work together to solve these problems. Innovative methods like using technology for digital payments and education programs to help people learn more about money can help solve problems and make microinsurance work even better at assisting disadvantaged groups to access cash and become more resilient.

Future Trends And Opportunities

Microinsurance will have a bright future. Many key trends and opportunities will shape its growth. One major trend is that artificial intelligence AI and big data analytics are increasingly used in microinsurance. AI can improve the accuracy of risk assessment and price making insurance goods more valuable and reasonable for low income people.

Big data analytics can help insurers learn more about their customers’ habits and likes which allows them to make better goods and get their customers more involved. Another new trend is the growing use of parametric insurance models in microinsurance.

In contrast to standard indemnity based insurance, parametric insurance pays out based on set events like changes in the weather or earthquakes. This method makes handling claims easier and lowers administration costs making it perfect for rural and impoverished areas that might need the proper infrastructure for standard procedures.

Microinsurance companies, states and development organizations are working together more and more which opens up opportunities to expand programs and better regulate them. Supportive policies and regulatory changes that encourage innovation and protect consumers in microinsurance markets are two essential ways governments can help make microinsurance markets work.

Conclusion

Microinsurance is one of the most important ways to help low income people worldwide become financially included and resilient. Microinsurance guards against unplanned events promote economic stability and give people more power by solving particular risks and obstacles that disadvantaged groups face.

Even though new technologies and policies always change things, microinsurance still has a huge impact on achieving sustainable development goals and fair growth. Promoting more knowledge funding and new ideas in microinsurance is important to ensure that its benefits reach the people who need them the most, making the world a better place for everyone.